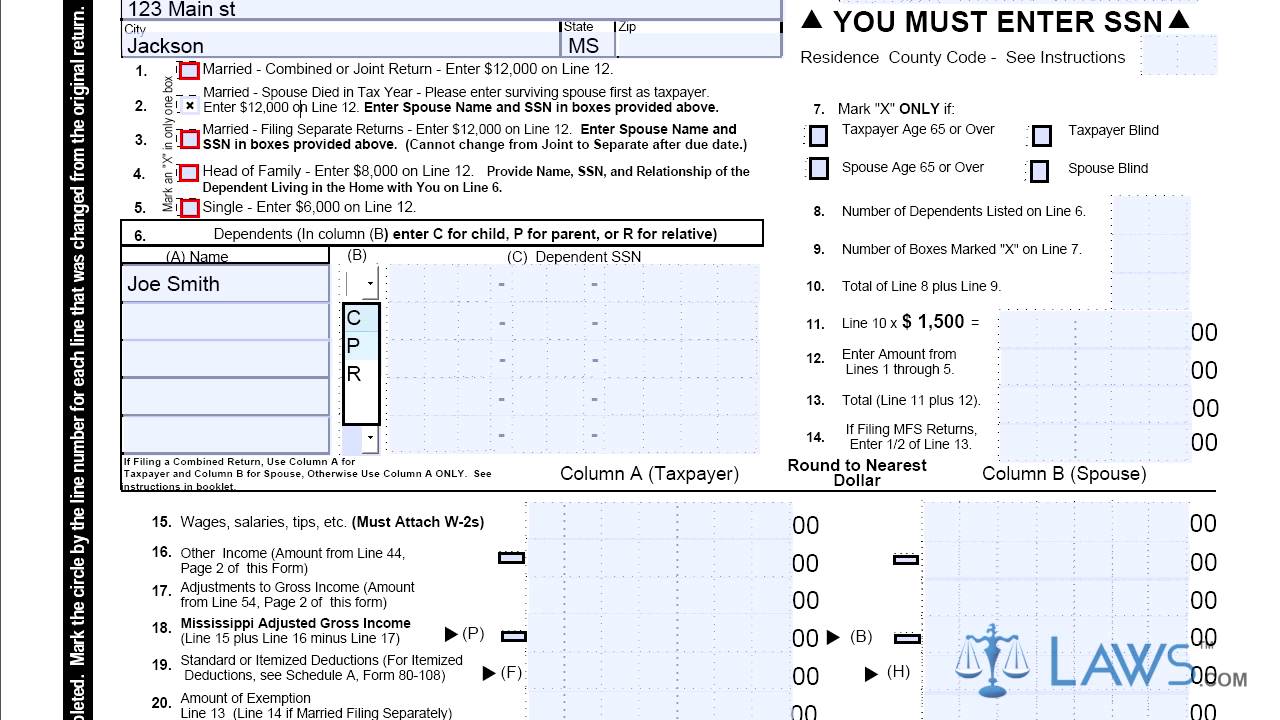

mississippi state income tax form

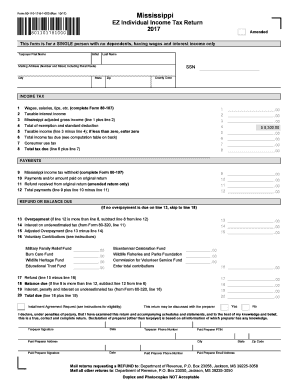

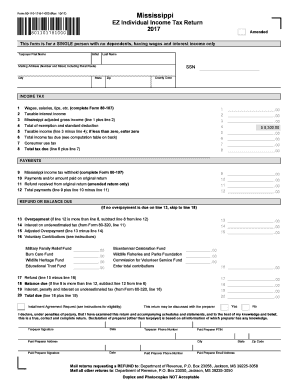

Form 80-105 is the general individual income tax form for Mississippi residents. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

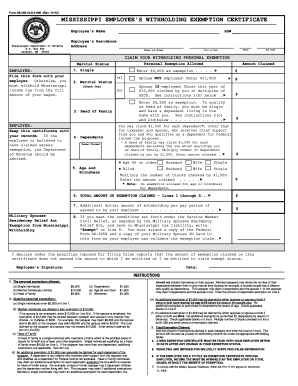

State W 4 Form Detailed Withholding Forms By State Chart

It is the same everywhere in the state with a few exceptions.

. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. Otherwise you must withhold Mississippi income tax from the full amount of your wages. This website provides information about the various taxes administered access to online filing and forms.

There is a single statewide sales tax of 7 in Mississippi. Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 are eligible for an. E-FIle Directly to Mississippi for only 1499.

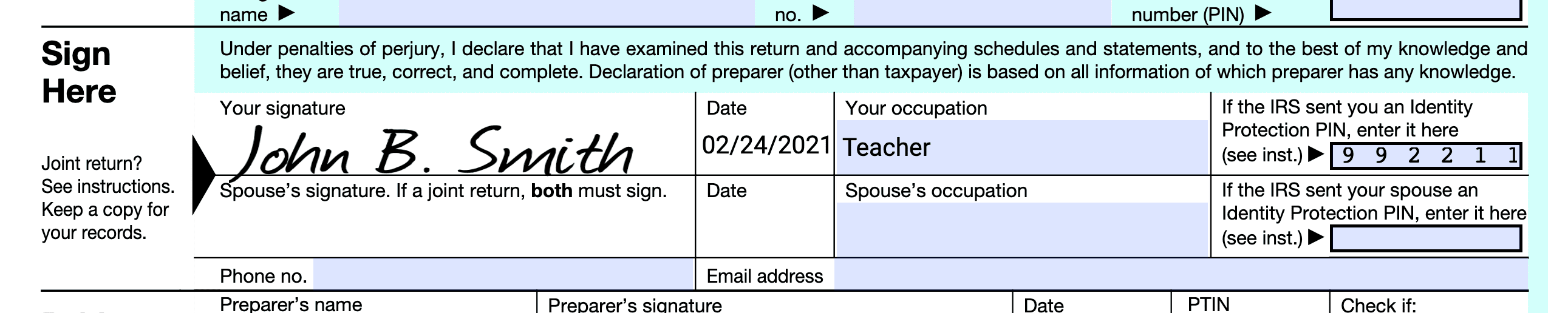

Check the Amended box to indicate that its an amended tax return. 0621 Mississippi Income Withholding Tax Schedule 2021 801072181000 Reset Form Print Form Primary Taxpayer Name as shown on Forms 80-105 80-205 and 81-110 THIS FORM MUST BE FILED EVEN IF YOU HAVE NO MISSISSIPPI WITHHOLDING A - Statement Information B -. Head of family a b.

The city of Jackson Mississippis state. A downloadable PDF list of all available Individual Income Tax Forms. Department of Revenue - State Tax Forms.

Attach other state return 19 Other credits from Form 80-401 line 1 21 Consumer use tax. The current tax year is 2021 with tax returns due in April 2022. Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue.

Form 89-140 - Annual W-2 and 1099 Information Return Fill In Version Form 89-386 - Affidavit for Withholding Income Tax on Sale of Real Estate by Non-Resident. Form 80-105 is the general individual income tax form for Mississippi residents. 819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE.

Ad Get A Jumpstart On Your Taxes. 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

Form 89-140 - Annual W-2 and 1099 Information Return Fill In Version Form 89-386 - Affidavit for Withholding Income Tax on. You must file online or through the mail yearly by April 17. Download Complete Form 80-105 or 80-205 for the appropriate Tax Year below.

Form 80-100 - Individual Income Tax Instructions. Import Your Tax Forms And File For Your Max Refund Today. Free 2021 Federal Tax Return.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The personal exemptions allowed. You may file your Form 80-105 with paper.

Mississippi does not have some of the tax credits common to other states such as the Earned Income Tax Credit or the Child and Dependent Care Tax Credit. You may file your Form 80-105 with paper forms through the mail or online with efiling. Ad Access IRS Tax Forms.

Sign Mail Form 80-105 or 80-205 to one of the addresses listed above. Single File this form with your employer. If you are receiving a refund.

All other income tax returns. 18 Credit for tax paid to another state from Form 80-160 line 13. The Department of Revenue is responsible for titling.

Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return. The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data. Bond Forms Form 89-350 - Withholding Exemption Certificate Completed by employee.

Complete Edit or Print Tax Forms Instantly. Mississippi tax forms are sourced from the Mississippi income tax forms page and are updated on. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms.

Tax Year 2021 only. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face. File this form with your employer.

Form 80-106 is a Mississippi Individual Income Tax form. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Welcome to The Mississippi Department of Revenue.

Ad E-File Free Directly to the IRS. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Taxpayer Access Point TAP.

Income and Withholding Tax Schedule 80107218pdf Form 80-107-21-8-1-000 Rev. Printable mississippi state tax forms for the 2021 tax year will be based on income earned between january 1 2021 through december 31 2021. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

You must file online or through the mail yearly by April 17. Most states will release updated tax forms between January and April. E-File Directly to the IRS State.

For rehabilitations qualifying only for the state tax credit the property owner must submit this three-part.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Fillable Online Form 89 350 Torrance Payroll Fax Email Print Pdffiller

Irs Mississippi State Tax Form 80 110 Pdffiller

Form 80 170 Mississippi Resident Amended Individual Income Tax Return Youtube

Individual Income Tax Forms Dor

Individual Income Tax Forms Dor

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Form 26as View Download Tax Credit Annual Information Statement Learn By Quickolearn By Quicko

Ms Dor 89 350 2020 2022 Fill Out Tax Template Online Us Legal Forms

Ms State Tax Refund Fill Online Printable Fillable Blank Pdffiller

How To Calculate Income Tax In Excel

Power Of Attorney Form Mississippi 4 Common Mistakes Everyone Makes In Power Of Attorney For Power Of Attorney Power Of Attorney Form Attorneys

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Mississippi Tax Forms And Instructions For 2021 Form 80 105

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax